- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

Property development is a complex process, but securing development finance does not have to be. Whether you are a property developer, investor, or landlord, there are various finance options available to help you get your next project off the ground.

For light to heavy refurbs, you can access a ‘refurbishment bridge’, which provides finance for 3-24 months of building costs, and may also offer the option to convert into a mortgage down the line. Ground-up developments often require more extensive finance, as they involve both land purchase and construction costs. In such cases, lenders may offer finance for up to 50% of the plot purchase and 75% of the build costs. This means that the developer may only need a fraction of their own money, instead of the full amount, to cover the land purchase and property construction.

Interest can be rolled or paid monthly, and repayment dates can be tailored to suit sales timelines. Most exit fees are calculated on the borrowed amount, not the GDV (Gross Development Value).

At Mortgage Decisions, we are experienced in helping you find suitable development finance. We also support less experienced developers and can consider impaired credit applications. Call the team on 03454 500200 or email hello@mortgagedecisions.com.

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances.

The fee is up to 1% but a typical fee is £595.

With access to 1000s mortgages from over 90 high street lenders, we can help you find the right mortgage. Our five-star Google reviews back this up. Call us now and speak to a member of our experienced team.

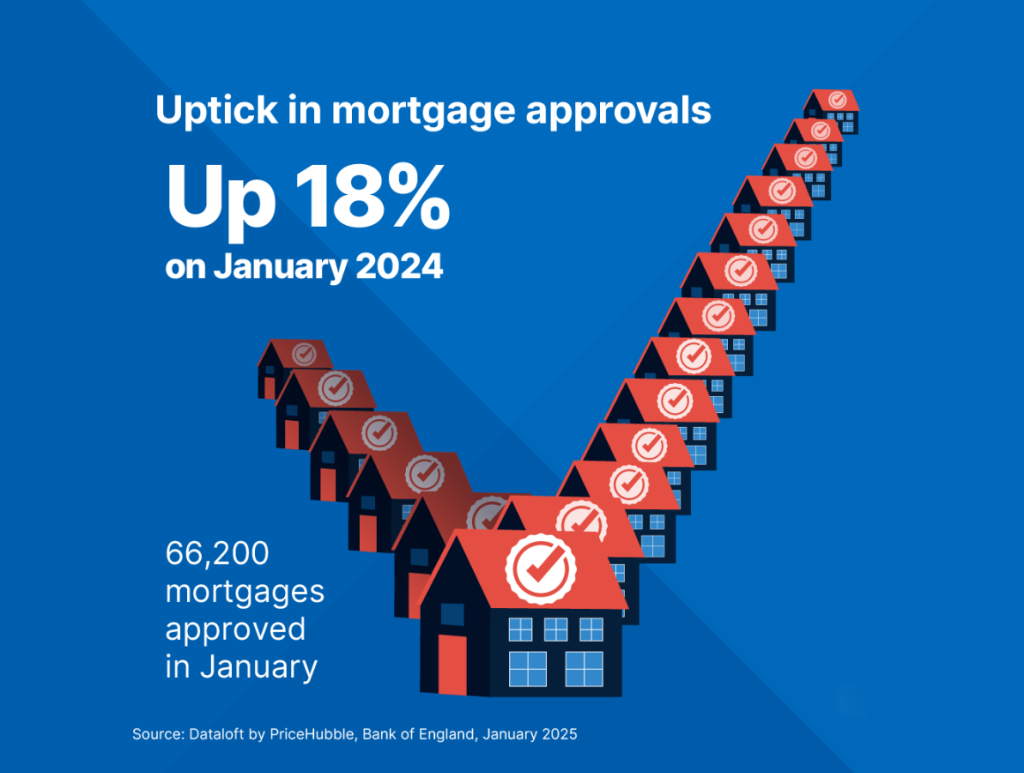

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

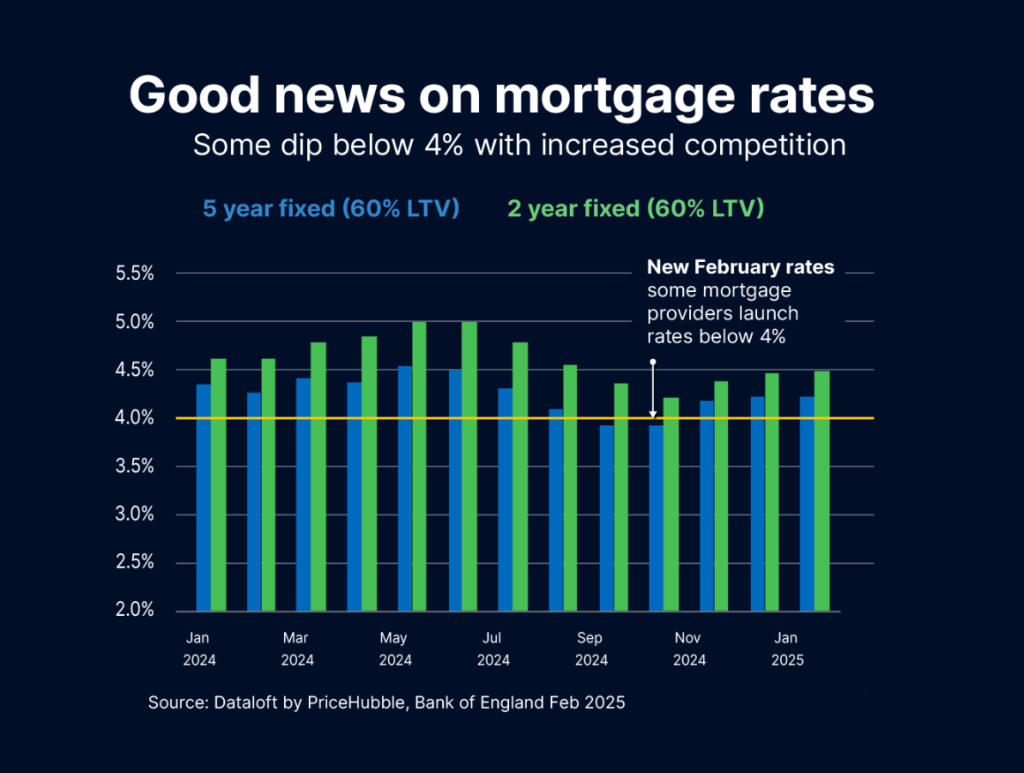

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…