- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

If you’re a dedicated member of the armed forces with dreams of owning your own home, the Forces Help to Buy Mortgage Scheme is your guiding light. At Mortgage Decision, we recognise your commitment and understand the unique challenges you face. That’s why we’re proud to introduce you to a scheme designed exclusively for individuals like you – those who serve our nation selflessly.

Imagine being able to borrow up to half of your annual salary, interest-free, to contribute towards buying your first home, moving to a new residence, or extending your current one. With a maximum borrowing limit of £25,000, this initiative paves the way for you to achieve homeownership without the burden of exorbitant upfront costs.

What sets the Forces Help to Buy Scheme apart is its flexibility. It’s not just about obtaining a loan; it’s about making the journey towards your dream home smoother. Whether you’re starting from scratch or looking to climb the property ladder, this scheme adapts to your needs.

But it’s not just about financial assistance. It’s about empowerment. It’s about recognising your dedication to our nation and providing you with a tangible reward. Our team of experts is well-versed in the Forces Help to Buy Mortgage Scheme’s intricacies. We’re here to guide you through the process, ensuring you have all the information you need to make informed decisions.

What’s more, the Forces Help to Buy loan isn’t solely meant for your deposit. It’s a versatile resource that can be used for various costs associated with home buying, such as estate agency fees, stamp duty, solicitors’ fees, and more. This versatility opens doors to opportunities that might have seemed out of reach before.

The Forces Help to Buy Scheme is embraced by major mortgage lenders, opening your mortgage options and further affirming its credibility and significance. This recognition means that your journey towards owning a home is backed by industry professionals who understand and value your service.

We understand that transitioning to a new home comes with financial considerations. That’s why the Forces Help to Buy loan comes with a repayment period of up to 10 years, alleviating the immediate financial stress and making your homeownership journey more manageable.

At Mortgage Decisions, we’re committed to your journey. We’re here to support you as you take the monumental step towards homeownership. Your dedication deserves to be rewarded, and the Forces Help to Buy Mortgage Scheme is our way of giving back.

To find out more about this Scheme, contact the team on 03454 500200 or email hello@mortgagedecisions.com. We can help you find the right mortgage.

The Forces Help to Buy Scheme is a government-backed initiative in the United Kingdom designed to assist members of the armed forces (Royal Navy, RAF, British Army) in achieving homeownership. It enables eligible military personnel to borrow a deposit of up to half of their annual salary, with a maximum loan amount of £25,000, without incurring interest charges.

This loan can be used towards purchasing their first home, moving to a new residence, or extending their current property. The scheme aims to alleviate the financial burden associated with purchasing a home and provide military personnel with more accessible pathways to becoming homeowners.

The Armed Forces Help to Buy scheme operates by allowing eligible military personnel to borrow a portion of their annual salary as an interest-free loan. This loan serves as a deposit, which can be used to secure a mortgage for a property. The loan is interest-free for the first five years, and after that period, a low interest rate is applied to the outstanding amount.

The repayment of the loan occurs over a maximum period of ten years. This arrangement enables armed forces personnel to enter the property market with a reduced financial burden, making homeownership more achievable.

To be eligible for a Forces Help to Buy Mortgage, individuals must meet certain criteria set by the Ministry of Defence (MOD) in the United Kingdom. Eligibility requirements typically include:

Eligible members of the armed forces can borrow up to a maximum of 50% of their annual salary under the Forces Help to Buy Scheme. The borrowing limit is capped at £25,000. This interest-free loan serves as a deposit that can be used towards purchasing a home. The amount borrowed can contribute significantly to covering the initial costs associated with buying a property, such as the deposit, solicitor’s fees, stamp duty, and more.

Applying for the Forces Help to Buy Scheme involves a few steps:

The Forces Help to Buy loan is interest-free for the first five years. After the initial five-year period, a low interest rate is applied to the outstanding loan amount. This interest rate is generally lower than what you might find with traditional mortgages. The loan is repaid over a maximum period of ten years.

The repayment structure ensures that the financial burden is spread out over time, making it more manageable for armed forces personnel to transition into homeownership without facing immediate heavy repayment pressures. It’s important to remember that the terms and conditions of the loan repayment may vary depending on the lender and the specific details of your mortgage agreement.

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances.

The fee is up to 1% but a typical fee is £595.

With access to 1000s mortgages from over 90 high street lenders, we can help you find the right mortgage. Our five-star Google reviews back this up. Call us now and speak to a member of our experienced team.

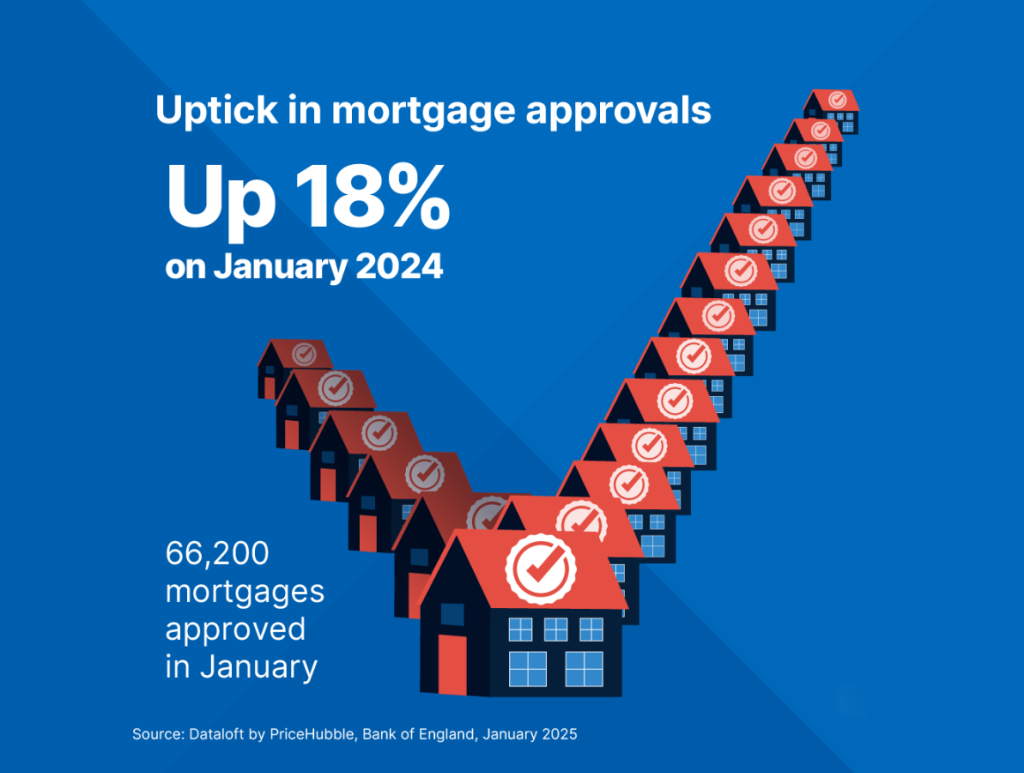

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

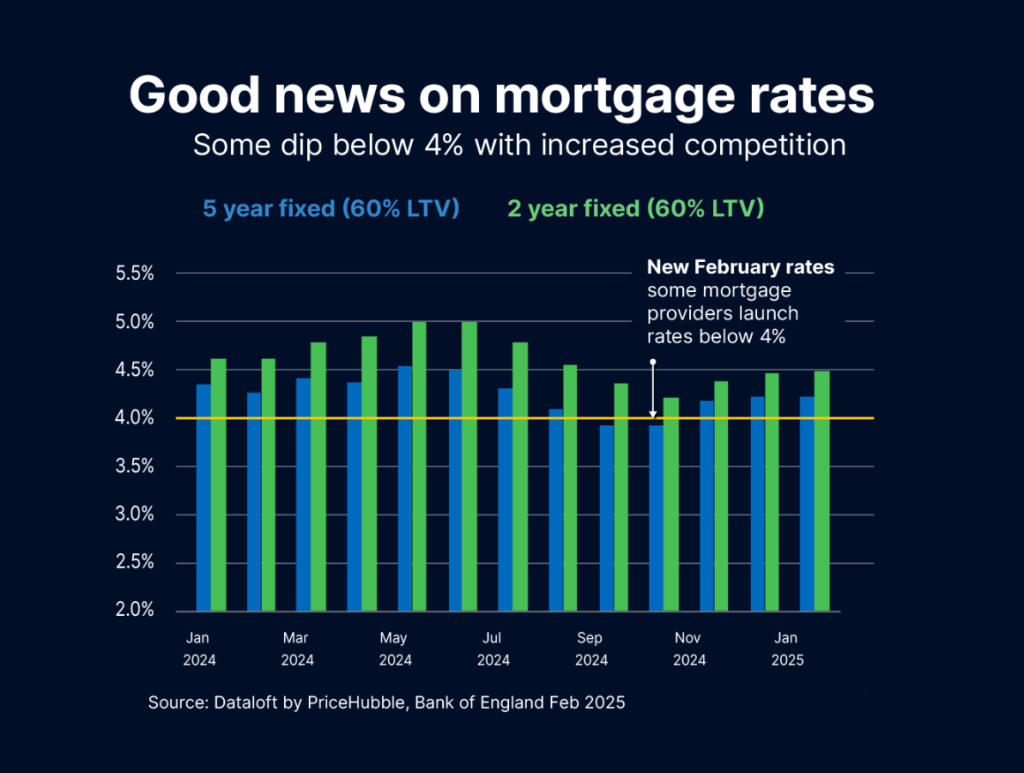

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…