- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

- Events

If you are self-employed and considering a mortgage, you may have questions about your eligibility for financing. It is important to explore the current options available to you, as lenders’ criteria can change frequently.

It is possible to secure a mortgage with less than two years of accounts, in fact, two years’ worth of accounts is typically considered satisfactory for self-employed individuals. Moreover, there are options available for those who have been self-employed for less than two years.

The reasons for seeking a self-employed mortgage may vary, such as using a mortgage calculator to accurately assess figures or obtaining a mortgage with only two years of accounts. As with any mortgage, it is advisable to seek the guidance of a specialist Mortgage and Protection Adviser to find the best fit for your specific needs.

Despite changes in stamp duty and HMRC calculations for property investors, Buy To Let mortgages remain a popular choice for self-employed individuals. While a larger deposit is typically required for Buy To Let mortgages compared to residential mortgages, there is still significant interest in lending to investors with deposits ranging from 15% to 40%. It is important to note that in Scotland, higher deposits are generally required and specialist advice may be necessary.

Although obtaining a Buy To Let mortgage may have been challenging for self-employed individuals in the past, lenders are now more willing to offer flexibility and relax their criteria. It is possible to secure a Buy To Let mortgage with only one or two years of accounts, or even without proof of income for experienced landlords. For first-time landlords, some lenders may consider lending based on a minimum income of £1. It is essential to shop around to find the best option.

Contractor mortgages, which were previously considered difficult to obtain, now have many options available in the market. Along with standard criteria such as credit rating, age, income, and property type, lenders also consider the length of time spent as a contractor, type of work, and previous contract renewals. While most lenders require a minimum of 12 months of trading history, some may consider applicants with six months of trading.

For partnerships and sole traders, the requirements for obtaining a mortgage are similar. A minimum trading period of 12 months is typically required, although some lenders may consider a shorter period. Loan to value, trading history, and multiples also play a role in the lending decision. It is important to note that some lenders may offer more flexible underwriting for applicants outside of their usual criteria, and a specialist loan or second charge lender may be an option for those looking to refinance and borrow additional funds.

When applying for a mortgage with a two-year account history as self-employed individual, you can prove your income by providing the following documents to the lender.

Average income: Lenders might consider the average of your income over the past two years, not just the most recent year’s figures. This helps account for fluctuations in contractor income.

Strong accountant (if applicable): Having a qualified accountant prepare your tax returns and accounts adds credibility to your application.

Clear documentation: Ensure all documents are clear, organized, and cover the required two-year period.

Limited track record: If you’ve been a contractor for less than two years, explain this to the lender. You might still qualify with strong contracts, a good credit score, and a larger deposit.

Alternative income sources: If you have other income sources (e.g., part-time job, pension), include proof of that income as well.

Yes, remortgaging with only 2 years’ accounts as a contractor is possible, but you need to meet specific criteria which vary from one lender to another. We will guide you through the process and find the best product based on your current circumstances.

A mortgage broker familiar with contractor mortgages can be a valuable asset. They can advise you on the documents you need, help you find lenders suited to your situation, and present your application in the most favourable light.

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances.

The fee is up to 1% but a typical fee is £595.

With access to 1000s mortgages from over 90 high street lenders, we can help you find the right mortgage. Our five-star Google reviews back this up. Call us now and speak to a member of our experienced team.

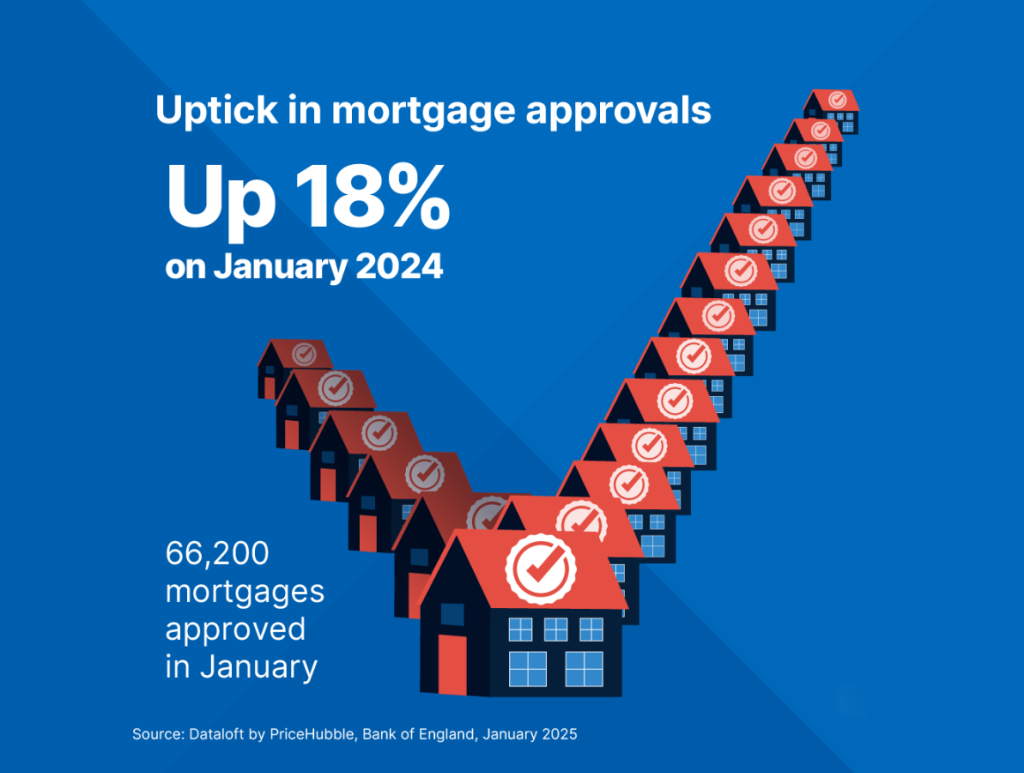

Mortgage approvals in January were 18% higher than a year earlier, as buyers look to secure properties before the nil-rate threshold for stamp duty reverts from £250,000 back to £125,000…

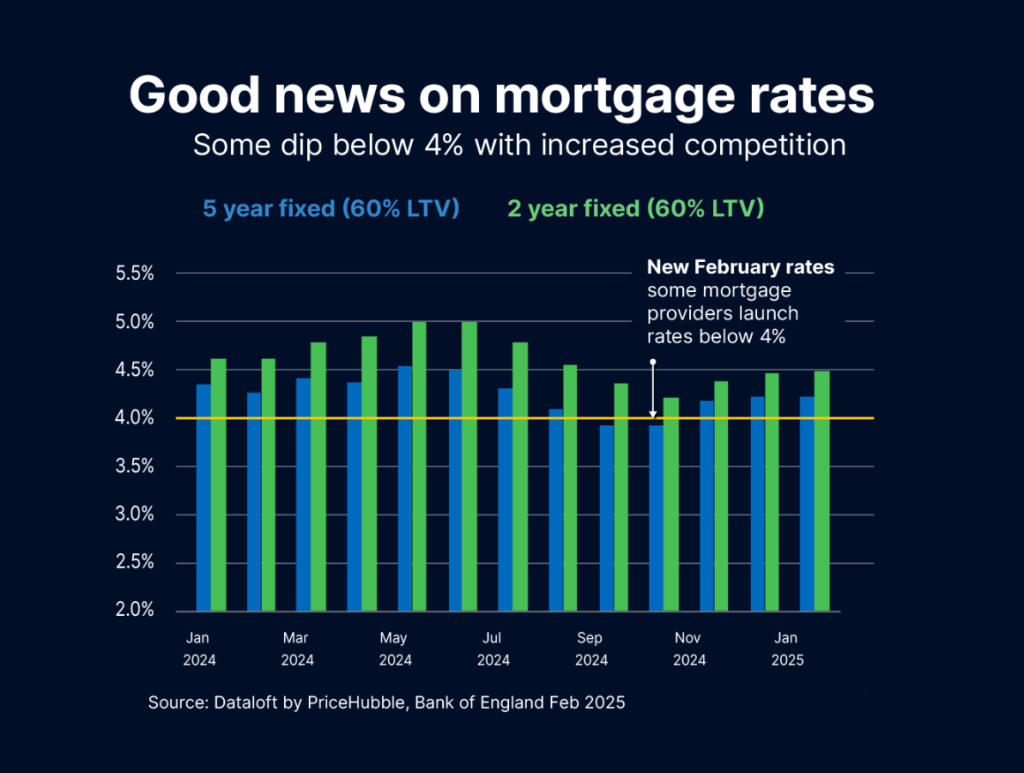

At Mortgage Decisions, it is noteworthy that several major lenders have recently introduced mortgage deals with interest rates below 4% for loans with a 60% loan-to-value ratio. Typically, interest rates…

A remortgage is essentially switching your existing mortgage to a new one. The process essentially involves switching from your existing mortgage to a new deal, either with your current lender…