- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

Family life insurance, often referred to as a policy that provides a lump sum to your loved ones in the event of your passing, aims to support your family with essential living costs. There are diverse policy options to cater to various needs, offering coverage for specific periods or lifelong protection.

The most suitable policy hinges on your family’s unique requirements. By comparing family life insurance quotes, you can secure the ideal coverage tailored to your situation at a competitive rate.

Family life insurance provides crucial financial support to your loved ones in the event of your passing, ensuring their security during a difficult time. The cost of family life insurance varies based on factors such as age, health, and lifestyle.

This type of insurance encompasses a range of products designed to safeguard families in the event of a primary breadwinner’s death. It offers a lump sum payment and can replace lost income for a specified period, covering daily expenses and future needs like education.

You pay a monthly premium to the insurer for the agreed protection level, and if you pass away during the policy term, your named beneficiaries (typically your spouse and/or children) will receive a lump sum or regular payments.

Tailoring your policy to suit your family’s needs is essential. Factors like your age, health, lifestyle, and desired coverage package influence the cost of insurance. Consider the amount of coverage needed, often around 10 times your annual salary to cover expenses like mortgages and bills.

Fixed Term policies pay out within a specific timeframe, making them ideal for protecting your family during key periods, such as until your children reach adulthood. Options include Level term insurance for a consistent payout and Decreasing term insurance, which adjusts the payout over time.

Whole life policies provide lifelong protection but come with higher premiums. The pay-out decreases as you age, ensuring your family receives more in the event of premature death.

Single policies cover one individual, while joint policies cover multiple individuals. Opting for a joint policy can be cost-effective, with the pay-out typically going to the surviving parent.

Decide whether your beneficiaries receive a lump sum or regular payments based on your family’s needs. It’s advisable to seek financial advice on managing the payout effectively. Regularly review your policy to ensure it aligns with your family’s situation, especially if circumstances change significantly. Notify your beneficiaries about the policy to expedite the payout process.

Consider setting up a trust for underage beneficiaries to manage the funds until they are of age. When taking out a joint policy, the surviving policyholder will receive the pay-out.

Select your beneficiaries thoughtfully with a single policy. In the absence of a surviving parent or guardian, arrangements can be made to manage the funds until the children are of age to handle them independently, typically requiring legal assistance.

To find out more about Family Life Insurance, please contact a member of the team on 03454 500200. We would love to help.

For insurance business we offer products from a choice of insurers.

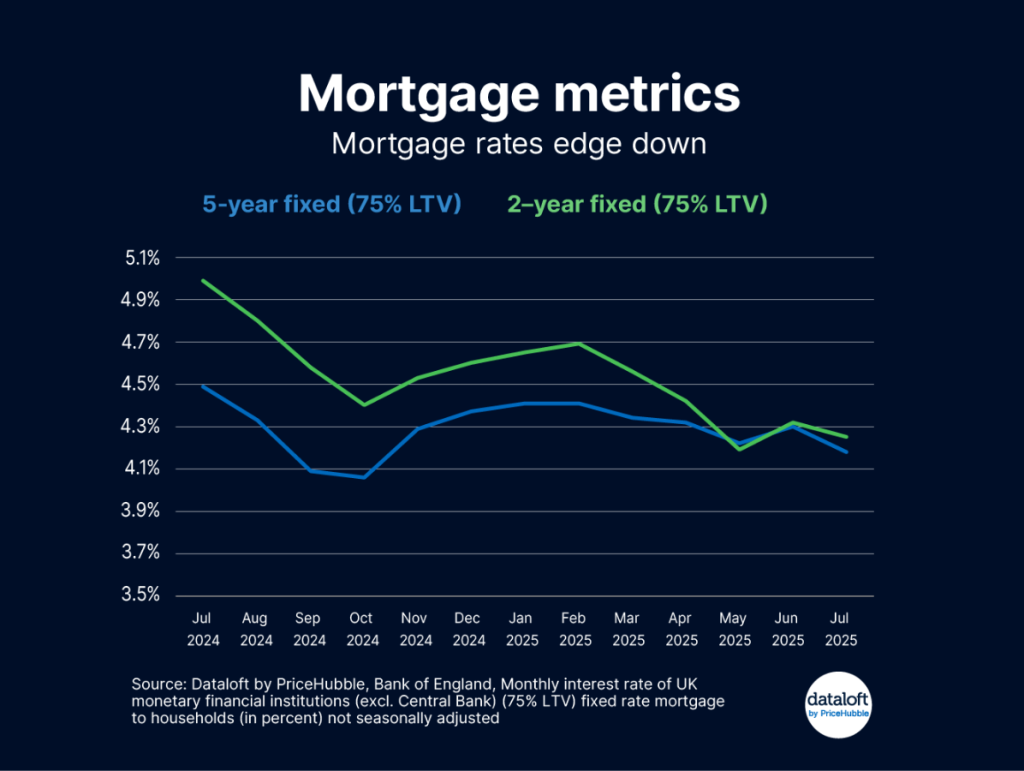

Mortgage rates have fallen after August’s bank rate cut. The average two-year fixed rate is now 4.25%, down from 4.99% a year ago, while the five-year fixed rate is 4.18%,…

At Mortgage Decisions, our mission is to provide exceptional mortgage and protection advice that genuinely helps our clients achieve their financial goals. We’re proud to be a trusted name in…

Access to a Wider Range of Mortgage Deals – Mortgage Advisers have access to exclusive deals, here at Mortgage Decisions we are part of Mortgage Advice Bureau (MAB) which unlocks…