- Mortgages

Mortgages

Bad Credit Mortgages

- Shared Ownership

- Insurance

Insurance

Life Insurance for Families

Life Insurance for Seniors

- Specialist lending

- About

Securing the best life insurance as a smoker doesn’t need to feel overwhelming. Although the cost may be higher due to your habits, it’s still possible to find affordable coverage.

Key points for life insurance for smokers – you will be classified as a smoker if you use cigarettes, cigars, vapes, or e-cigarettes. To be considered a non-smoker, you must be nicotine-free for at least 12 months (duration may vary by insurer), including nicotine replacement products.

The cost of coverage is generally lower when you are younger.

You can obtain life insurance even if you are a smoker. Whether you smoke cigarettes, cigars, use vapes/e-cigarettes, or have quit smoking in the past, there are life insurance options tailored to your needs.

It’s important to note that as a smoker, you may encounter ‘loaded’ premiums, reflecting the higher risk you present to the insurer. To find the most cost-effective coverage for your unique situation, comparing quotes from different providers is highly recommended.

When applying for life insurance, it is important to disclose if you are a smoker. Insurers require this information to accurately calculate your monthly premium.

You will likely be asked a straightforward yes or no question regarding your smoking status. If you answer yes, you may need to provide additional details about your smoking habits, such as:

It is crucial to be transparent about your smoking habits during the application process. Remember, being a smoker is unlikely to result in a denial of coverage. Honesty is key when it comes to obtaining life insurance.

Life insurance serves as a crucial financial safeguard for your loved ones in the event of your passing.

Smoking is associated with a higher risk of developing certain medical conditions, underscoring the necessity of having appropriate protection in place for unforeseen circumstances.

Most commonly, insurers will classify you as a smoker if you’ve regularly used any nicotine, tobacco or substitutes in the last 12 months. This includes cigarettes, cigars, smoking a pipe, e-cigarettes, vaping (both nicotine and non-nicotine-based liquids) and nicotine patches, gum or lozenges.

However, the time period can vary between insurers and could be as long as five years.

For insurance business we offer products from a choice of insurers.

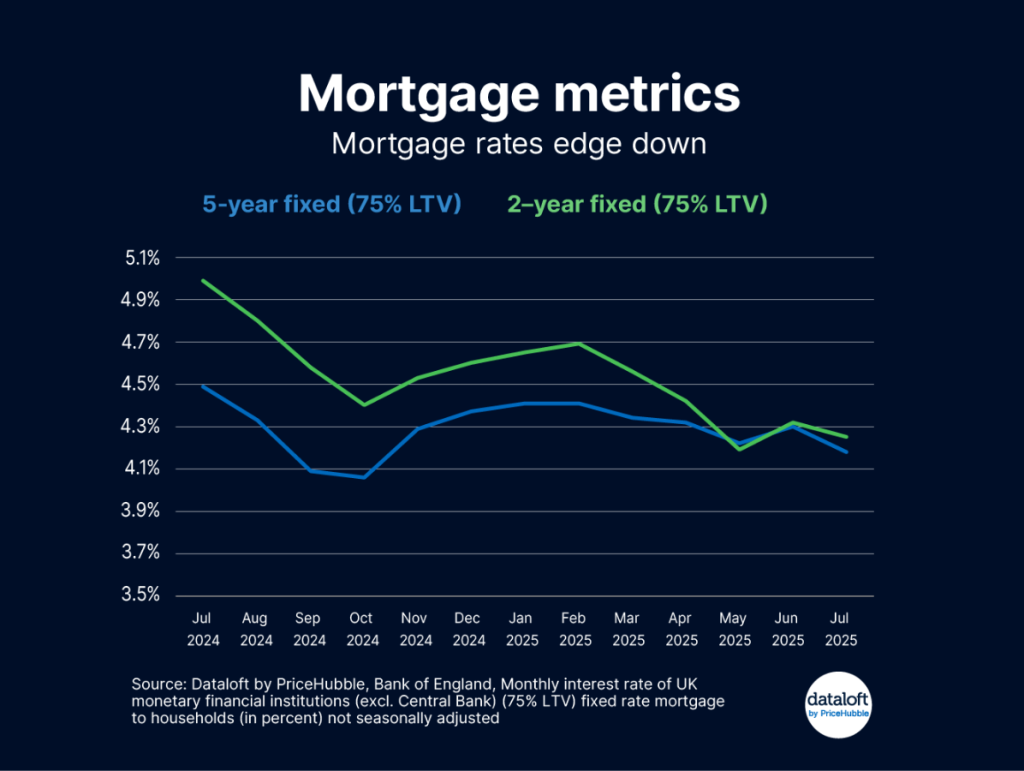

Mortgage rates have fallen after August’s bank rate cut. The average two-year fixed rate is now 4.25%, down from 4.99% a year ago, while the five-year fixed rate is 4.18%,…

At Mortgage Decisions, our mission is to provide exceptional mortgage and protection advice that genuinely helps our clients achieve their financial goals. We’re proud to be a trusted name in…

Access to a Wider Range of Mortgage Deals – Mortgage Advisers have access to exclusive deals, here at Mortgage Decisions we are part of Mortgage Advice Bureau (MAB) which unlocks…